If you’re thinking about starting to get involved in the trading. First, you need to learn how it works and what extraordinary cases have occurred in the market.

Investments are directly connected with money, which means that it’s a very risky thing and you shouldn’t enter into it unprepared. Because there can be many different unforeseen situations that can cause you to lose your money or your investment strategy to simply fail.

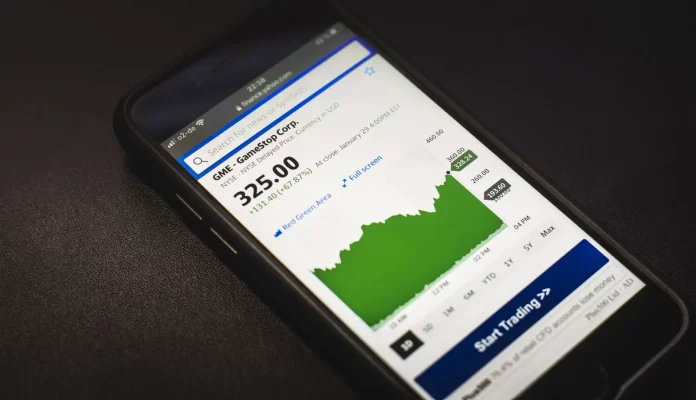

As an example of a very atypical situation for the market, the GameStop stock case in 2021.

What is the GameStop case 2021

In January 2021, a short-squeeze in GameStop stock began, which means that the share price was rising quickly due to an excess of short selling. This is due to lack of supply and excess demand for the stock due to sellers having to buy the stock to cover their short positions.

It was initiated by users of a forum on Reddit called r/wallstreetbets. This has caused, and even still causes, significant financial losses for some major traders in the U.S. stock market. Funds such as Citadel LLC, Melvin Capital, Susquehanna International Group, and others were affected.

About 140 percent of the shares of GameStop that were in a free float at the time were sold short, and the rush to buy them drove the stock even higher. At the peak of the short-squeeze activity, GameStop’s stock price reached a value of over $500. This was almost 30 times its value at the beginning of the month, $17.25.

Then the short-squeeze was deliberately stalled with a ban on buying GameStop stock.

What were the consequences of the stock purchase freeze

Against this background, the price of other securities and some cryptocurrencies also rose. Because of this, some brokerage companies suspended buying GameStop shares on January 28. At the time, they said that they simply couldn’t place enough collateral in the clearing houses to fulfill their clients’ orders.

This provoked a lot of criticism and accusations of market manipulation from various politicians and businessmen. After that, Robinhood was sued in dozens of U.S. courts. Also, in this case, the U.S. House of Representatives Committee on Financial Services held a hearing in Congress.

After that, the high prices and volatility still continued. On February 24, the price of GameStop stock doubled in 90 minutes and stood at about $200 a share for the next month.

After March 24, the share price fell 34 percent to $120. And then, after the company announced its earnings and plans for a secondary offering, the price was up 53 percent again.

What is GameStop

GameStop is an American video game chain. It operates on the simple principle of brick and mortar. Because of growing competition from digital distribution stores, the company has been struggling. It was also affected by the economic effects of the Covid-19 pandemic. Because at the time of the pandemic, the number of people who were shopping in person was significantly reduced.

The result was that the company’s share price went down and many investors started short-selling them. As of Jan. 22, 2021, about 140 percent of GameStop’s public shares had been sold short. This meant that some shares were re-credited and sold again. Express reports that this has only happened 15 times in the last 10 years.

What were the consequences

As a result of this short squeeze, the Melvin Capital investment fund, which was short-selling GameStop, lost about 53% of its value.

Citadel LLC and its partners had to invest $2 billion in Melvin, and Point72 Asset Management added $750 million, bringing the total emergency financial infusion into that fund to $2.75 billion

Some hedge funds closed their short positions and sold their stocks to be able to reduce their leverage and exposure.

Funds that played the long side were able to make good profits. For example, Senvest Management LLC bought shares of GameStop back in September 2020 at $10 and earned about $700 mln. This allowed the fund to gain 38%.

In total, it’s reported that investors lost about $6 billion in total due to the short squeeze. As of January 27, 5,000 U.S. companies had losses on short positions, and their losses on short positions exceeded $70 billion.