Investors should be careful with green papers and funds – these are typical immature market instruments.

There are times in the market when you can make money very quickly, even though fundamentally nothing has changed in the economy. A clear example: March – April of last year, when thanks to the coronavirus the situation gave investors the opportunity to get excellent returns, on a short, 6-9-month horizon.

Today, however, everything about the topic of renewable energy and ESG investment paradoxically looks exactly the opposite. Yes, undoubtedly it is an important and interesting story in the long term, but it is quite difficult to make money on this phenomenon now, in June 2021, on a 2-3 quarter time horizon.

Why invest in green technology

Why is green energy not just a fashion, but a long-term trend? Because due to a number of fundamental factors, the topic of climate change and responsible treatment of the planet has gone from being interesting only for a loud-voiced minority to becoming mainstream. As a classicist would say, this idea has taken hold of the masses and become a material force. Moreover, it has become an element of global competition. Those countries that were able to find the right tools and ways to address this topic will have a serious, decades-long advantage in international economic competition.

At the International Climate Summit in late April, the major economies made generous promises. Let’s see what we should expect. America has promised to reach zero net CO₂ emissions by 2050 and reduce its greenhouse gas emissions by 50-52% by 2030. Europe promises to reach net-zero by 2050 and reduce emissions by 55% from 1990 levels by 2030, tightening its previous pledge by 15%. Japan: no-zero by 2050. The three major economic players have already made commitments.

What about China? The largest emitter of pollutants is promising no-zero by 2030 (which is less than nine years away). (which is less than nine years away) to peak and start reducing, with the prospect of becoming net-zero by 2060. Given the rapid growth of the Chinese economy, this is a serious promise; however, China may now be preparing an even more ambitious program, which it will unveil in November at the International Climate Conference in Glasgow.

Moreover, not only in China and Europe but also in the U.S., both regulatory restrictions and fiscal incentives for the green economy are radically increasing after several years of Trumpian sabotage. The former are the compression of emissions limits, and an example of the latter is the same Biden’s $1.9 trillion, eight-year stimulus program, a large “chunk” of which is for renewable energy.

Are green investments new to the market?

The topic of green investments is not new to the market, and a surge in the value of the relevant instruments has already occurred, often even with an overshoot. That’s why you have to be very careful: isn’t the market overheating?

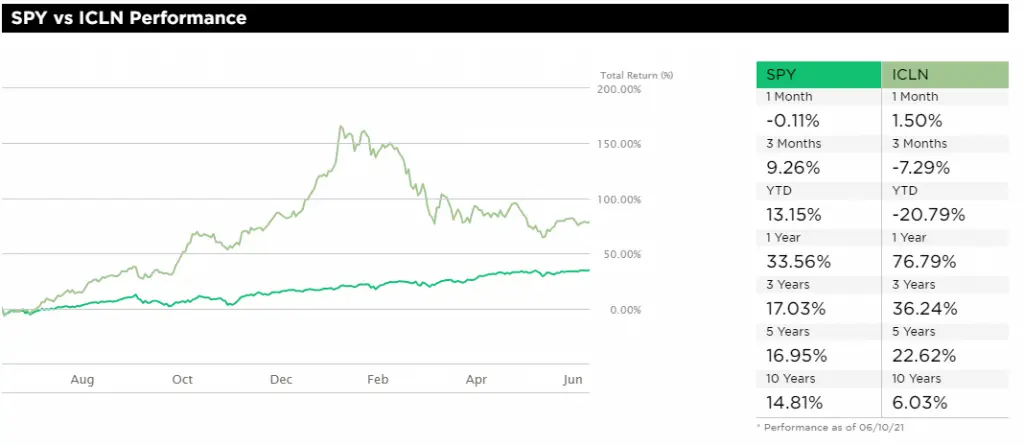

An example is the large iShares Global Clean Energy ETF (ICLN), which has seen a three-year performance of 36.24%. Sounds good, but what if we look at performance over the past three months (we get -7.29%). By comparison, the S&P 500 ETF Trust (SPY) showed a three-year performance of 17.03% and the last three months of 13.15%.

That means that if you had invested in ICLN at the beginning of the year, you would have lost about 13%, and by investing in the S&P 500 you would have gotten an 11% return.

Yes, on a one year horizon the picture is the opposite (76.79% in ICLN vs 33.56% in SPY) but that just confirms the huge volatility.

One very simple conclusion to draw from this is that green papers and funds are typical instruments of an immature market that lacks information, investors and experience.

They can create interesting value that comes with high risks, suitable only for very experienced investors who can survive such fluctuations. The level of noise and excitement in the market is inadequate, but if you read the market signals correctly, you can make money. However, I repeat – for this you must be a professional investor who knows how to understand the market, calculate your investments and not succumb to stress.