On Thursday, July 1, online broker Robinhood Markets filed for an IPO on the NASDAQ, and this is, without any doubts, one of the most awaited offerings of the whole of 2021. I think you know what’s Robinhood, but let me shortly remind you. This service is positioning itself as a simple service that can help people to start trading with the low entry threshold. Its main audience is newcomers to investing, people who just want to try trading and make some money.

Also, I will remind you that on June 30 Robinhood was fined $70 million by FINRA for “misleading clients and encouraging risky strategies”. But seems that this fine wouldn’t affect Robinhood’s IPO plans.

So now let’s take a look at the company and its IPO.

What are Robinhood products?

The main products stated in the prospectus, in addition to stock trading (that’s the company’s main business):

- bank cards (current accounts);

- fractional shares;

- Cryptocurrencies;

- Robinhood Gold – premium subscriptions;

- Robinhood Learn – educational and media materials;

And if the three first points are clear for understanding, the two last ones should be clarified for those, who aren’t trading with Robinhood.

Robinhood Gold

Robinhood Gold is a $5 per month paid subscription. What does it give? It gives access to advanced market data, analytics from MorningStar, and instant top-ups (money is deposited to your account when you send it, not when a wire transfer is processed).

As of March 31, 2021, Robinhood had 1.4 million paid subscribers.

Robinhood Learn

There’s a great media wing dedicated to learning how to trade and data insights, so that’s not just a common learn-how-to-trade appendix with some basic materials. Robinhood Learn includes Snacks, a daily publication (32 million subscribers) that delivers news and analytics daily and weekly in the form of a newsletter, podcast, and video.

It also includes around 650 articles and tutorials on finance and investing (7 million views) and news feeds giving free access to closed Wall Street Journal, Barrons, Reuters content, and insights(6.4 million users).

Also, it gives access to Robinhood Lists – trading tools created by users (9.5 million users).

Robinhood users and assets

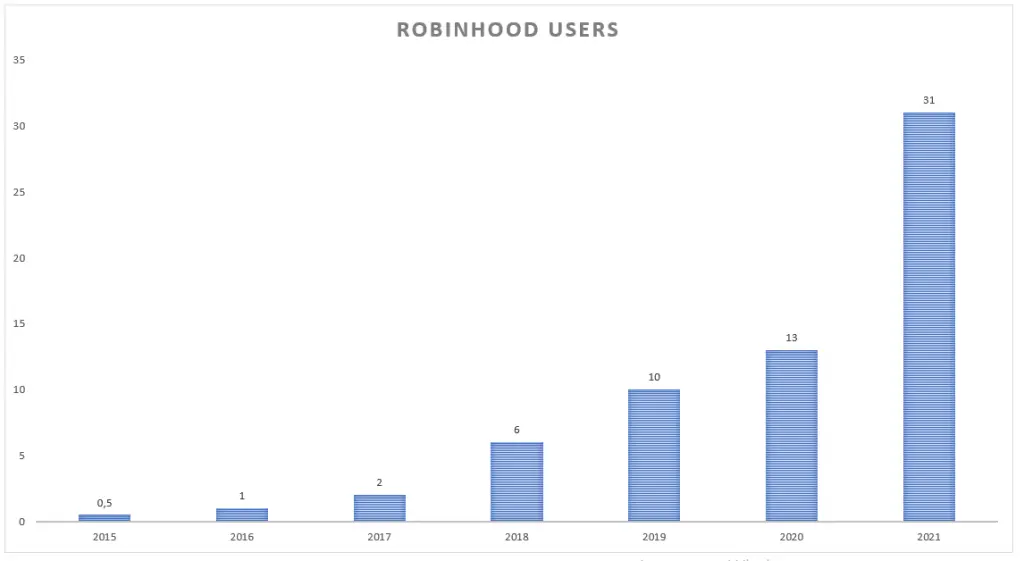

Robinhood’s user base has almost tripled in the last year, and its growth rate has accelerated significantly. Robinhood reports 31 million active accounts with positive balances and $85 billion under management.

That’s not so big amount, by the way, (around 2,75 thousand dollars per trader) however, this corresponds with Robinhood’s strategy and aiming at beginner traders.

Robinhood financial indicators

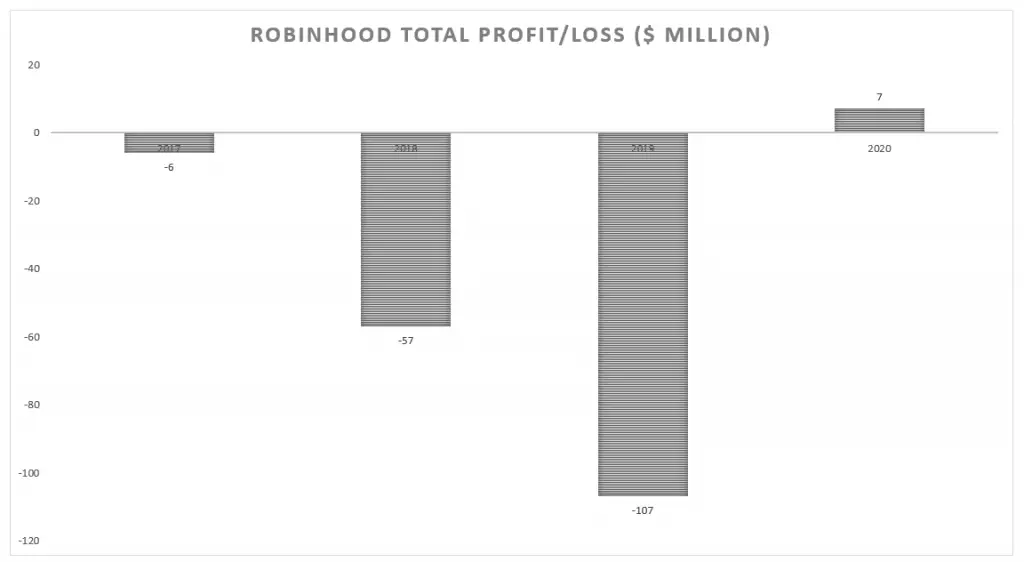

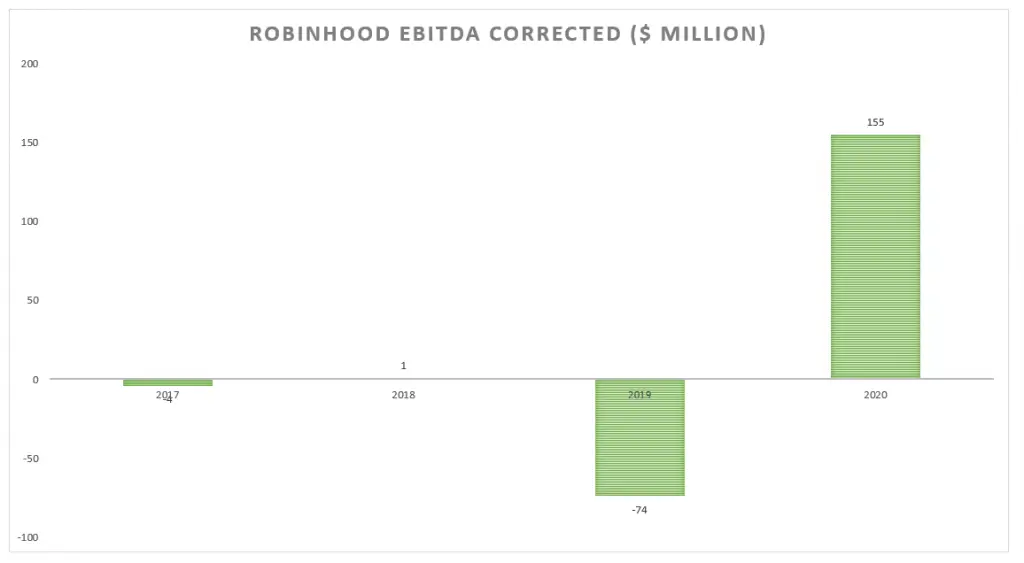

2020 was Robinhood’s first profitable year, but the company earned only $7.45 million. By comparison, 2019 was the highest year ever, with a loss of about $107 million.

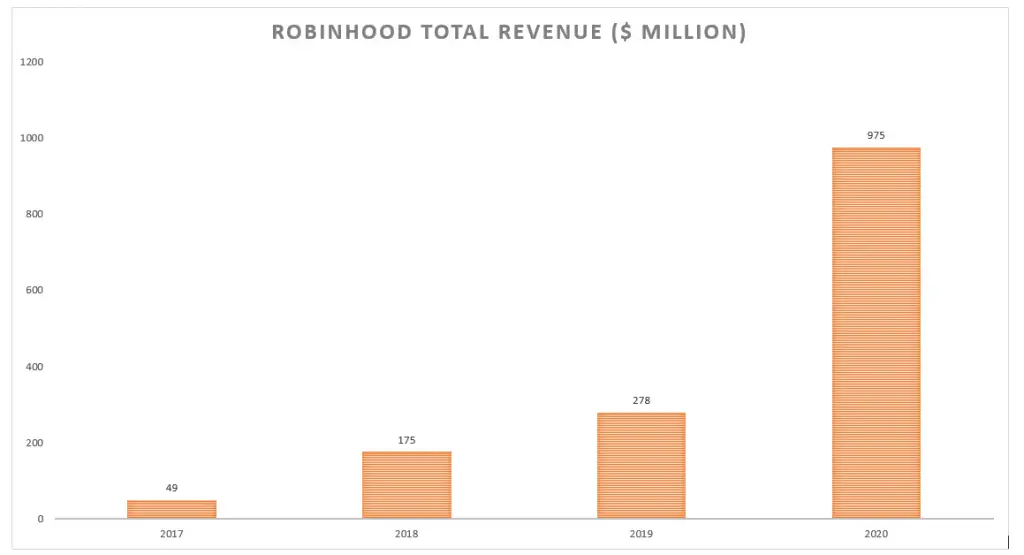

However, there was a tangible increase in total revenue. While in 2019 it was only $278 million, in 2020 it has already risen to $975 million. This is due to both an increase in the number of active users and an increase in revenue per user.

38% of the company’s profit in the first quarter came from options, 25% from stocks and 17% from cryptocurrencies (most of it from Dogecoin).

Robinhood earns about 2% of client assets. Robinhood earned $82 per client in 2020 and $137 in the first quarter of 2021.

For the first quarter of 2021, revenue rose from $128 million to $522 million. Nevertheless, the total loss for the first quarter was $1.4 billion.

GameStop incident

Many media outlets attributed the $1.4 billion loss in the first quarter to the Gamestop incident, but there is no reference to that in the document itself, instead, it says that the loss is due to an adjustment on convertible notes:

We incurred a net loss of $1.4 billion, which included a $1.5 billion fair value adjustment to our convertible notes and warrant liability.

The way it looks from the outside: convertible notes were issued, Robinhood incurred a nominal loss when the value of the shares increased (the price of the shares pledged became higher than the amount borrowed). Either way, it’s not directly related to the business.

Cryptocurrencies

Robinhood’s crypto user assets are 1/10th of Coinbase’s ($12 billion vs $111 billion, Q1 2021), crypto brings 17% of revenue (although they honestly write in the prospectus that this is due to Dogecoin and not sure it will continue). In just one year, cryptocurrency trading volume on the platform increased 10-fold.

Marketing efforts

In the first quarter of 2021, marketing expenses increased by $32.3 million, or 46%, compared to the previous year – mainly due to expenses related to Robinhood’s referral program (+$31 million). Thus, the company spends disproportionately little on marketing compared to development costs or user base growth.

Robinhood plans for IPO: What the company wants to achieve

Many sources indicate the amount to be raised in the offering as $100 million, but this is just a provisional value, written in before all the details of the offering are clarified.

In reality, Robinhood plans to sell 20-35% of the stock at a valuation of about $35 billion, which would amount to $6-12 billion. The pre-IPO valuation, meanwhile, has already risen to $59 billion.

Robinhood’s perspectives

Robinhood states in its prospectus that the investment market is valued at $50 trillion. The company also notes that 50% of Robinhood’s clients are new to investing. That means this broker significantly influences the market and increases its size – if it weren’t for Robinhood, these investors wouldn’t have started investing.

The company notes that cash management doesn’t make money yet, but the market for debit accounts is huge, plus there are more credit cards and there are microtransactions, and in the long run Robinhood wants to become a single window for money management. And not only in the U.S., but all over the world, where there is a $250 trillion market (this is an open hint to future international expansion).

Risks and threats

Many standard phrases are written in the risk block, among which this one stands out: “Introducing new products and services or changing existing products and services may not help attract and retain customers or drive growth and profits.”

There are three main growth requests in the prospectus:

- We will grow the ecosystem and add new services.

- We will continue to grow share in the U.S. and go international.

- We will grow with the audience.